The Evolution of Payment Methods: How Crypto Solutions Are Disrupting the Industry

Sep 22, 2023

6 min read

Contents

The Evolution of Payment Methods

Disrupting the Payment Landscape

Innovative Solutions like Inqud

Challenges and Opportunities

The Future of Payments

Share

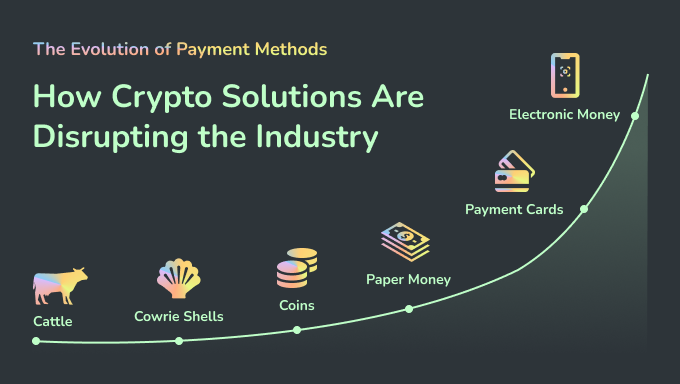

The world of payments is undergoing a significant transformation, driven by technological advancements and changing consumer preferences. Traditional payment methods, once dominated by cash and checks, have evolved into a diverse ecosystem of digital solutions. Amid this evolution, cryptocurrencies have emerged as a disruptive force, challenging the status quo and redefining the way we conduct transactions. In this article, we will explore the journey of payment methods, from their early forms to the rise of cryptocurrency solutions, and delve into the role of innovative platforms like Inqud in shaping the future of finance.

The Evolution of Payment Methods

The history of payments is a testament to human ingenuity and the quest for efficiency. From barter systems to the introduction of coins and paper money, societies have consistently sought ways to simplify the exchange of goods and services. The evolution gained momentum with the advent of banking systems, credit cards, and electronic funds transfers. These innovations not only increased convenience but also laid the foundation for the digital revolution that followed.

In the tapestry of our daily lives, the act of purchasing and paying has seamlessly woven itself into a routine that occurs multiple times each week. But how did we arrive at the intricate system we know today? Here's a retrospective journey through the key milestones that have shaped the landscape of payments:

Barter System: The inception of barter can be traced back to the Neolithic era, coinciding with the emergence of agrarian and livestock-based societies, possibly predating 7000 BC. Barter, the direct exchange of goods and services for others, marked humanity's first organized approach to trade.

Advent of Coins: Coins, making their debut between 680 and 560 BC in present-day Turkey, marked a pivotal leap in payment evolution. As barter's limitations surfaced, particularly its transactional complexities and the perishability of certain trade mediums, the use of coins emerged. Crafted from precious metals, their circular design was chosen for practicality.

Rise of Paper Money and Banknotes: A response to the inconvenience of carrying heavy coins, paper money and banknotes surfaced as alternatives. The first instances of banknotes date back to 7th-century China, gaining official recognition by 812. Notably, until the 1970s, national currency issuance was backed by specific quantities of gold.

Emergence of Bills of Exchange and Checks: Bills of exchange, originating in 12th-century Italy, assured creditors payment by debtors or authorized intermediaries. Checks, on the other hand, were conceived around the 18th century and linked to the English Crown.

Arrival of Cards: The year 1914 witnessed the inception of credit cards, initiated by the Western Union, which introduced a loyalty card granting exclusive customers credit access. However, banks officially introduced payment cards in 1958, with the pioneer known today as Visa.

Digital Payment Revolution: The advent of the Internet and World Wide Web in 1990 heralded the transition of commerce to this virtual realm. Pioneers like Peapod initiated online grocery shopping via computers. Over recent years, the digital revolution, coupled with novel technologies, has paved the way for mobile phone and digital watch payments.

Cryptocurrencies Unveiled: The concept of cryptocurrencies began to crystallize in 1998 when Wei Dai proposed a decentralized currency based on cryptographic control. This conceptualization led to the birth of cryptocurrencies. Early attempts came from David Chaum, employing DigiCash and eCash. Yet, the watershed moment arrived in 2009 when Satoshi Nakamoto, an enigmatic pseudonym, birthed the first cryptocurrency - Bitcoin.

Disrupting the Payment Landscape

The disruption caused by cryptocurrencies is multi-faceted. Their decentralized nature eliminates the need for intermediaries, reducing transaction fees and processing times. Cross-border payments, which were once plagued by high fees and delays, have become more efficient through cryptocurrencies. Furthermore, cryptocurrencies have enabled financial inclusion by providing access to financial services for individuals in underserved regions.

Innovative Solutions like Inqud

In this era of disruption, platforms like Inqud have emerged to bridge the gap between cryptocurrencies and traditional payment systems. Inqud offers user-friendly widgets that seamlessly integrate cryptocurrencies into everyday transactions while retaining the familiarity of fiat currencies.

This innovative approach ensures that users can harness the benefits of cryptocurrencies without the complexities often associated with them. Whether it's buying, selling, or exchanging cryptocurrencies, Inqud's solutions make the process convenient and accessible.

Challenges and Opportunities

Despite their transformative potential, cryptocurrencies also face challenges. Price volatility, regulatory uncertainties, and security concerns remain significant hurdles to widespread adoption. Governments and regulatory bodies are grappling with how to manage these digital assets within existing legal frameworks. However, the growing interest and investment in the cryptocurrency space signal its increasing acceptance and potential to reshape the financial landscape.

The Future of Payments

As cryptocurrencies continue to gain traction, they are inspiring innovation across the payments industry. Traditional financial institutions are exploring ways to incorporate blockchain technology into their operations, aiming to enhance efficiency and security. Central banks in several countries are even considering the development of digital currencies, blurring the lines between traditional and digital payments.

In conclusion, the evolution of payment methods is a journey marked by innovation and adaptation. From barter systems to cryptocurrencies, each phase has brought us closer to a more efficient and inclusive financial future. Cryptocurrencies, with their decentralized nature and disruptive capabilities, are reshaping the industry and challenging established norms. Platforms like Inqud are playing a pivotal role in making these solutions accessible to a wider audience. As we look ahead, it's evident that the future of payments will be characterized by a dynamic interplay between tradition and innovation, with cryptocurrencies at the forefront of this transformation.

Industries

IMB, SMB

Products

Сard2crypto, Crypto widget, API

Tags

Cryptocurrency, Payment methods, local payments, Cryptocurrency

Author

Alexandra Sokolova

,

Crypto Content Writer

Inqud Solutions for Your Business

Crypto Payments

Start accepting cryptocurrency payments from customers worldwide

Digital Currency Widget

Embed a cryptocurrency payment widget on your website

Auto Billing

Set up automatic subscription and recurring billing in crypto

Payment link

Create and share payment links for crypto transactions

Crypto Gateway

Enable users to buy crypto with fiat currency seamlessly